Cultural Resources

|

|

ECONOMIC JUSTICE/FINANCIAL LITERACY SUNDAY

CULTURAL RESOURCES

Sunday, February 19, 2012

DeForest B. Soaries, Jr., Guest Cultural Resource Commentator

Senior Pastor, First Baptist Church of Lincoln Gardens, Somerset, New Jersey

I. Historical Section

|

|

In 1953 Martin Luther King, Jr. delivered the sermon titled “The False God of Money.” In that sermon he explained the twin goals of economic justice and financial responsibility. That sermon is as relevant today as it was back then. After the 1957 Bus Boycott, King became the preeminent voice of the Civil Rights Movement. However, prior to his rise to national prominence, Dr. King preached about the dangers of unhealthy attitudes about money.

In the 1953 sermon King described three problems that occur when people make a god out of money. The first problem identified is that it causes people to be more concerned about making a living than making a life. The second is that it is accompanied by a selfishness that justifies attaining money by any means including exploitation, cheating, and robbery. The third fault that King found with those who worship money is that it breeds what he called “moral cowardice and corruption.”

These views held by King are not as well-known as some of his later pronouncements but they reveal that there was an economic analysis and perspective that served as a foundation for Dr. King’s later work. A copy of “The False God of Money” is available in the Martin Luther King Papers project at Stanford University and can be accessed via this link:

http://mlk-kpp01.stanford.edu/primarydocuments/Vol6/19July1953TheFalseGodofMoney.pdf.

In keeping with his focus on economic justice, Dr. King organized “Operation Breadbasket” in Chicago to put pressure on companies to hire black people who represented a large portion of their customers. Dr. King appointed Reverend Jesse Jackson as the director of the Breadbasket Program. One of the strategies that Jackson used to convince companies to hire black people was to ask black people to stop shopping at a particular store to show the owners how much they depended on the dollars spent by black people. This strategy was called a boycott and many companies were influenced by boycotts to start hiring black people.

|

Rev. Adam Clayton Powell, Jr. |

In the 1930s Rev. Adam Clayton Powell, Jr., the pastor of the historic Abyssinian Baptist Church in Harlem, New York, and the first African American to be elected to the United States Congress from New York, formed the Coordinating Committee for Employment. This organization sponsored activities to pressure New York businesses to hire black people.

II. Songs for This Moment on the Calendar

Booker T. Washington, the founder of Tuskegee University, was a passionate advocate of industrious enterprise and economic self-development among black people. The song that became known as the Negro/Black/African American National Anthem was written as a tribute and introduction for Washington by James Weldon Johnson, a principal of a segregated school that Washington was visiting. “Lift Every Voice and Sing” is always an inspiring song for hope and uplift among black people. Verse three is less popular than verse one but has powerful language for economic empowerment.

Lift Every Voice and Sing

1. Lift every voice and sing,

‘Til earth and heaven ring,

Ring with the harmonies of Liberty;

Let our rejoicing rise

High as the listening skies,

Let it resound loud as the rolling sea.

2. Sing a song full of the faith that the dark past has taught us,

Sing a song full of the hope that the present has brought us;

Facing the rising sun of our new day begun,

Let us march on ‘til victory is won.

3. Stony the road we trod,

Bitter the chast’ning rod,

Felt in the days when hope unborn had died;

Yet with a steady beat,

Have not our weary feet

Come to the place for which our fathers died?

4. We have come over a way that with tears has been watered,

We have come, treading our path through the blood of the slaughtered,

Out from the gloomy past,

‘Til now we stand at last

Where the white gleam of our bright star is cast.

5. God of our weary years,

God of our silent tears,

Thou who has brought us thus far on the way;

Thou who has by Thy might

Led us into the light,

Keep us forever in the path, we pray.

Lest our feet stray from the places, our God, where we met Thee,

Lest our hearts drunk with the wine of the world, we forget Thee;

6. Shadowed beneath Thy hand,

May we forever stand,

True to our God,

True to our native land.

R. Kelly also wrote an inspiring song, “I Believe I Can Fly,” which has this chorus:

I believe I can fly

I believe I can touch the sky

I think about it every night and day

Spread my wings and fly away

I believe I can soar

I see me running through that open door

I believe I can fly

I believe I can fly

I believe I can fly.

Those who become financially literate are able to fly and to help others soar to great economic heights.

III. Cultural Response

I once read an article about a fellow who had a big executive job and a good career. He’s now making $12 an hour as a custodian. What bothered me about the article is that he was quoted as having said this: “I am just a custodian.” What does he mean just a custodian? Didn’t he hear Dr. King when he said, “If you’re a street sweeper, sweep streets like Michelangelo painted pictures.” I was so upset by his describing his work with a word like just!

First of all, our church would be a complete mess if we didn’t have custodians. Do you know what an airport would look like without a custodian? You wouldn’t go to the bathroom at the restaurant if you didn’t think there was a custodian who had cleaned it. The whole quality of our lives is in large measure kept together by custodians.

I also considered the fact that honest work is both honorable and recommended in the Bible. The apostle Paul said that those who are unwilling to work should not eat (2 Thessalonians 3:10). When God rested on the seventh day of Creation, God rested from work.

Unfortunately, there are so many attractive schemes for gaining wealth without working that too many people have arrived at the conclusion that they can become wealthy without doing any work at all. In the words of Proverbs 12:11 they engage in worthless pursuits.

I should have written this custodian a letter and said: “Don’t you ever say you’re just a janitor.” It was a janitor at Nishuane Elementary School in Montclair, New Jersey, who had a degree in his back pocket, but because of segregation, they wouldn’t let him teach. A janitor, who when he swept the floors, would eavesdrop on the teachers talking about me, and then he came back and saved my life. A black janitor named Mr. Brown saved my life. How dare you say you’re just a janitor!

IV. Audio Visual Aids and Other Suggestions

There are a few items that may be useful in creating an environment conducive for this moment:

|

- Worshippers can be asked to bring credit card offers they receive in the mail to church and deposit them in a garbage receptacle to symbolize resisting the temptation of going into debt.

- Worshippers can be asked to bring credit cards that they have paid off and will never use again and, after cutting them up, deposit them in a garbage receptacle to symbolize that they are becoming financially literate.

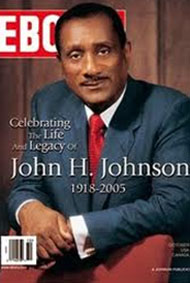

- Photos of African American business leaders such as Madame C. J. Walker (below left), Earl Graves (below middle), and John H. Johnson (below right) may be displayed on the bulletin/order of worship and/or around the church on this Sunday and beyond.

|

|

|

- Church members who own businesses can be recognized to emphasize entrepreneurship.

- Information about free financial literacy classes, credit, banking, and finances can be distributed and information about each placed in your bulletin/order of worship.

- Short video clips from financial speakers such as Kelvin Boston of the PBS show “Moneywise” can be shown this Sunday in Sunday School classes and featured this week in Bible Study and even during morning worship.

- A survey can be taken to identify financial needs of your congregation and the results announced during this Sunday along with ways that your church will seek to meet these needs through initiatives such as financial literacy classes, résumé writing classes, computer classes, budgeting classes, debt consolidation classes, etc.

- A special ongoing Financial Empowerment Ministry can be launched on this day.

V. Illustration

I once taught a course on race relations at a community college. All of my African American students believed that the United States government had a special program that helped Asian immigrants start their own businesses by providing them with start-up capital. How else, my students thought, could so many Asian immigrants enter the country, speak very little if any English, and become the owners of strategically located business in predominantly black neighborhoods? It had to be the government that was making this happen. So I invited a young Asian businessman who had done that very thing—bought a business on a prime corner in the black neighborhood—to be a guest speaker in my class.

What my students heard shocked them. This young man had come from his country to America with thirteen dollars. He lived in an apartment with some relatives who had already moved here. He slept on the floor. He worked in their business and spent very little money. He owned two shirts, one pair of black pants, one pair of shoes, underwear, and a few other accessory items. After saving most of his income he joined a group of a dozen people who had also emigrated from his country and who met monthly for something they called a ki. This was a kind of investment group that would put a certain amount of money in a pot once a month and each month one person would take all of the money. The next month person number two would take the money. And so on. This would happen for the number of months that equaled the number of people in the group. And then they would start a new group. This young man wanted to buy a business that required 30,000 dollars in cash. So he joined a group of 15 people who put in 2,000 dollars every month. He could afford that because despite his low salary, he saved almost everything he earned. And when his turn came, he took his 30,000 dollars and bought his business. My students wanted to know how he could trust this system to work. Suppose someone did not show up the next month. There were no contracts, no paperwork, no credit checks, no government oversight. It was an honor system and this, he said, was a part of his culture. We need a culture change that makes this kind of behavior normal among Christians.

VI. dfree—A Strategy for Getting Out of Debt

dfree is a strategy I developed for people to learn how to manage their life by managing their finances. dfree is not another financial literacy program assuming that all people need is information. The movement is based on a belief that living in debt is an emotional, spiritual, and psychological problem as much as it is an educational and informational one. dfree examines the four vital keys to debt-free living that have helped hundreds of families in the church I pastor get out of debt. By replacing the “get more money” mentality with a “get out of debt” approach to financial freedom, not only were hundreds of people able to go debt-free, but my church’s offerings have increased by $1 million dollars—during the recession.

- Read dfree: Breaking Free from Financial Slavery.

- Track your spending for 30 days.

- List all of your ongoing bills.

- Establish a spending plan (budget).

- Establish a monthly calendar of payments.

- Stop using all credit cards.

- Start a dfree™ class using an approved curriculum.

- Obtain a free copy of your credit report.

- Decide when you will be debt free.

VII. Making This Moment on the Calendar Memorable

Financial literacy and economic justice are ongoing needs and require ongoing responses. Here are some resources that can help make that happen.

Quiz

Take the Debtorsanonymous.org quiz

Most compulsive debtors will answer “yes” to at least eight of the following 15 questions. Be honest.

1. Are your debts making your home life unhappy?

2. Does the pressure of your debts distract you from your daily work?

3. Are your debts affecting your reputation?

4. Do your debts cause you to think less of yourself?

5. Have you ever given false information in order to obtain credit?

6. Have you ever made unrealistic promises to your creditors?

7. Does the pressure of your debts make you careless of the welfare of your family?

8. Do you ever fear that your employer, family, or friends will learn the extent of your total indebtedness?

9. When faced with a difficult financial situation, does the prospect of borrowing give you an inordinate feeling of relief?

10. Does the pressure of your debts cause you to have difficulty sleeping?

11. Has the pressure of your debts ever caused you to consider getting drunk?

12. Have you ever borrowed money without giving adequate consideration to the rate of interest you are required to pay?

13. Do you usually expect a negative response when you are subject to a credit investigation?

14. Have you ever developed a strict regimen for paying off your debts, only to break it under pressure?

15. Do you justify your debts by telling yourself that you are superior to the “other” people, and when you get your “break” you’ll be out of debt overnight?

How did you score? If you answered yes to eight or more of these questions, the chances are that you have a problem with compulsive debt, or are well on your way to having one. If this is the case, today can be a turning point in your life.

We have all arrived at this crossroad. One road, a soft road, lures you on to further despair, illness, ruin, and in some cases, mental institutions, prison, or suicide. The other road, a more challenging road, leads to self-respect, solvency, healing, and personal fulfillment. We urge you to take the first difficult step onto the more solid road now.

Books

|

Butler, John Sibley. Entrepreneurship and Self-Help among Black Americans: A Reconsideration of Race and Economics. New York, NY: State University of New York Press, 2005.

|

|

Singletary, Michelle. The Power to Prosper: 21 Days to Financial Freedom. Grand Rapids, MI: Zondervan, 2010.

|

|

Mundis, Jerrold. How to Get out of Debt, Stay Out of Debt, and Living Prosperously. New York, NY: Bantam Books, 2003.

|

|

Soaries, DeForest B. Jr. dfree®: Breaking Free from Financial Slavery. Grand Rapids, MI: Zondervan, 2011. |

|

Schor, Juliet B. The Overspent American: Why We Want What We Don’t Need. New York, NY: Harper Perennial, 1998. |

Websites